A new employer-based effort aims to tackle workplace anxiety and boost performance by using cost-free debt resolution services. With U.S. customer financial obligation at a record $17.05 trillion, this program gives workers with individualized strategies for monetary alleviation and security.

A new program aimed at reducing workplace anxiety and enhancing productivity with worker debt resolution services is being introduced by entrepreneur David Baer and his companions. The effort, which is offered to employers free-of-charge, addresses the growing economic pressures facing American workers and their influence on service efficiency.

According to a current study by Experian, U.S. consumer debt reached a record $17.05 trillion in 2023. Credit card equilibriums increased by over 16% in one year, and almost half of Americans currently lug revolving financial debt. These monetary strains are adding to enhanced worker stress, absenteeism, and lowered performance throughout different industries.

Acknowledging this challenge, Baer, who experienced the hardships of financial obligation after a organization endeavor failed, pioneered this program to supply functional alleviation to workers. "I recognize firsthand the emotional toll that financial debt can handle a person," Baer claimed. "Our objective is to give staff members the devices to fix their debt so they can concentrate on their personal and professional goals."

The program is created to be easily accessible and versatile. Employers can implement it flawlessly at no cost, giving their labor force access to individualized debt resolution solutions. Furthermore, people can enlist in the program independently through Debt Resolution Solutions.

Baer stressed that this effort is not just a win for staff members however likewise for companies looking for to reduce turn over and absenteeism. "Financial stress doesn't just stay at home; it walks into the office on a daily basis," Baer explained. "By supporting staff members in overcoming their financial burdens, companies can cultivate a more engaged, faithful, and productive labor force."

Trick functions of the financial debt resolution program consist of:

Tailored Financial Debt Decrease Plans: Staff members collaborate with professionals to produce tailored approaches based on their special financial circumstances.

Legal Assistance: Partnered with a debt resolution law practice, the campaign guarantees individuals get skilled guidance to browse intricate debt issues.

Financial Health Resources: Participants gain access to educational materials that advertise long-lasting financial wellness and literacy.

The effort lines up with research demonstrating that workplace wellness programs addressing monetary wellness cause higher staff member fulfillment and retention rates. In fact, business that buy such programs report a 31% reduction in stress-related absence and an typical performance rise of 25%.

" Monetary stress does not stay at home-- it comes to deal with you," Baer emphasized. "Our initiative provides business a means to proactively resolve this problem. When employees really feel encouraged to take control of their finances, they end up being more concentrated, encouraged, and dedicated to their employers."

Why Dealing With Financial Wellness Is Secret to Workforce Security

The American Psychological Association (APA) has continually reported that financial concerns are just one of the top sources of stress and anxiety for adults in the united state Over 70% of participants in a recent APA survey specified that cash problems are a considerable stress factor in their lives. This stress and anxiety has straight implications for workplace performance: employees distracted by personal financial concerns are most likely to experience burnout, miss out on target dates, and seek out new job possibilities with greater wages to cover their financial debts.

Monetarily stressed out employees are also much more prone to health and wellness issues, such as anxiety, anxiety, and high blood pressure, which contribute to boosted health care costs for employers. Addressing this trouble early, through extensive financial obligation resolution solutions, can alleviate these dangers and cultivate a much healthier, a lot more stable workforce.

Baer's vision for the program expands beyond prompt treatment. He wishes it will certainly catalyze a wider cultural change in just how businesses watch employee wellness. "Companies have made terrific strides in recognizing the importance of mental wellness and work-life equilibrium. Financial health ought to be viewed as equally important," Baer claimed. "Our goal is to make debt assistance programs a standard benefit in offices across the country."

Program Accessibility and Next Actions

Companies and HR professionals curious about providing the financial obligation resolution program can go to DebtResolutionServices.org for more details on implementation. The site supplies an summary of services, FAQs, and accessibility to program professionals who can help tailor the effort to satisfy the details requirements of a company's labor force.

The program is similarly accessible to people outside of a formal company offering. Staff members that do not have gain access to via their office can join directly on the exact same website to start obtaining assistance for their debt challenges.

Baer wrapped up, "This program is about more than just numbers. Menopause Energy Restoration It has to do with bring back peace of mind to millions of Americans and giving them a pathway to financial freedom. When employees flourish economically, the entire company benefits."

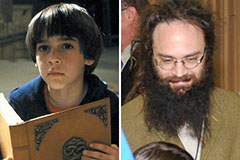

Barret Oliver Then & Now!

Barret Oliver Then & Now! Joseph Mazzello Then & Now!

Joseph Mazzello Then & Now! Barry Watson Then & Now!

Barry Watson Then & Now! Shane West Then & Now!

Shane West Then & Now! Nancy McKeon Then & Now!

Nancy McKeon Then & Now!